Welcome to Vivna Insurance of Tennessee

Tennessee health insurance feels easier to compare when you have clear information and licensed guidance. Vivna Insurance helps individuals, families, and self-employed professionals understand ACA Marketplace coverage, private medical insurance, short-term and tri-term medical options where available, dental and vision coverage, life insurance, and supplemental insurance so you can choose coverage that fits your needs and budget.

Because plan details can vary by provider networks, prescriptions, and cost-sharing, we focus on education first. That way, Tennessee residents can compare coverage types, understand tradeoffs clearly, and make confident decisions without pressure.

To learn more about coverage categories, visit:

Health Insurance •

Supplemental Insurance •

Life Insurance •

UnitedHealthcare

If you have questions and want to speak with a licensed agent, call

888-730-6001.

VIVNA ONLY WORKS WITH

CARRIERS YOU CAN TRUST

Understanding Tennessee Health Insurance Options

Tennessee health insurance choices are easier to evaluate when you understand how plan types work and what each option is designed to do. Vivna Insurance helps residents review major medical coverage, related benefit categories, and common cost terms so you can compare options with confidence.

Because every household has different doctors, prescriptions, and budget priorities, we focus on education first. That way, you can make a clear decision based on real needs instead of marketing noise.

Tennessee ACA Marketplace Coverage

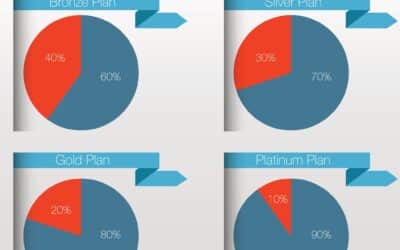

ACA Marketplace coverage provides comprehensive major medical benefits, including preventive care, hospitalization, emergency services, maternity care, mental health treatment, and prescription drug coverage. Many households may qualify for income-based premium assistance depending on household size and earnings.

When comparing ACA plans, it helps to review provider networks, prescription formularies, deductibles, and out-of-pocket maximums. Vivna Insurance explains these details in plain language so you can understand what you are buying before you choose a plan.

Private Health Insurance in Tennessee

Some Tennessee residents explore private medical insurance when they want plan designs that differ from Marketplace options. Private coverage can vary widely by underwriting rules, networks, and cost-sharing structures, so it is important to review plan documents carefully.

For a simple overview of major medical insurance concepts and plan categories, visit:

Health Insurance

Short-Term and Tri-Term Medical Options in Tennessee

Short-term medical coverage is available in Tennessee and may be considered for temporary gaps such as job transitions, waiting periods, or coverage changes. Tri-term options may extend temporary coverage across a longer timeframe while still remaining distinct from comprehensive ACA-compliant insurance.

Because temporary coverage can have limitations and eligibility requirements, Vivna Insurance helps explain key differences between short-term or tri-term options and ACA-compliant plans so you can evaluate whether temporary coverage fits your situation.

Dental and Vision Coverage

Dental and vision coverage can help manage routine care expenses, including exams, cleanings, basic procedures, eyewear, and preventive services. These plans are often available separately from medical insurance and can support a stronger prevention-first approach to health planning.

Supplemental Insurance Options

Supplemental insurance may provide additional financial support for certain events such as accidents, hospital stays, or critical illnesses. Some households add supplemental benefits to help reduce the impact of deductibles and cost-sharing that may still apply under major medical coverage.

Learn more about coverage categories here:

Supplemental Insurance

Life Insurance Options for Tennessee Residents

Life insurance can help protect long-term financial stability by providing a benefit that may support loved ones with income replacement, debt obligations, and future planning needs. Vivna Insurance explains how term and permanent coverage work so you can choose a policy that matches your goals.

Explore life insurance education here:

Life Insurance

Why Tennessee Residents Choose Vivna Insurance

Vivna Insurance provides licensed support with an education-first approach. We help Tennessee residents understand plan differences, evaluate tradeoffs clearly, and choose coverage that fits healthcare needs and budget expectations without pressure.

If you want to learn more about coverage categories in one place, start here:

Vivna Insurance

Frequently Asked Questions About Tennessee Health Insurance

How do I compare Tennessee health insurance plans?

Start by reviewing your preferred doctors, prescriptions, and household budget. Vivna Insurance helps explain how different plan types work so you can compare coverage options clearly before making a decision.

Are ACA Marketplace plans the only option in Tennessee?

No. Tennessee residents may review ACA Marketplace coverage, private medical insurance, dental and vision plans, life insurance, and supplemental insurance. Short-term and tri-term medical coverage may also be available for temporary situations.

Can dental and vision coverage be purchased separately?

Yes. Dental and vision plans are often available separately from medical insurance and can help manage routine care expenses such as exams, cleanings, eyewear, and preventive services.

Is short-term medical coverage available in Tennessee?

Yes. Short-term and tri-term medical coverage may be used in Tennessee for temporary coverage gaps such as job transitions or waiting periods. These plans are not intended to replace comprehensive ACA-compliant insurance.

How can I speak with a licensed insurance agent?

If you have questions or want help understanding your options, you can speak with a licensed agent by calling

888-730-6001.

Contact Vivna Insurance

888-730-6001

To complete the form below to request your personalized insurance review.

Get a Free Quote

For additional information about dental and vision care, you can explore trusted health resources such as the

National Institutes of Health (NIH) and the Centers for Disease Control and Prevention (CDC).

Vivna Insurance helps individuals and families compare coverage options, including Supplemental Insurance,

to support a well-rounded insurance strategy. To explore all coverage options and resources, visit the Vivna Insurance home page

or browse the latest guides in the Vivna Insurance Blog.

Health & Insurance Blog Insights

Secure Child Health Insurance | Step-by-Step Enrollment Guide

Secure Child Health Insurance by following simple enrollment steps that help families protect children with reliable medical coverage and affordable plans.

Health Insurance For Kids | Family Coverage Options Explained

Health Insurance For Kids helps families protect children from unexpected medical costs while ensuring access to preventive care and reliable treatment.

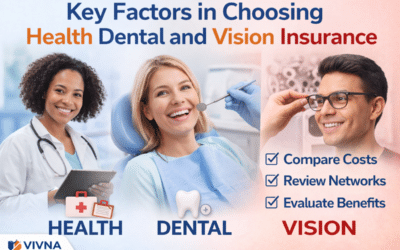

Key Factors in Choosing Health Dental and Vision Insurance

Learn key factors in choosing health dental and vision insurance, including costs, provider networks, and coverage benefits.

Affordable Health Insurance Provider | Coverage Guide & Plan Comparison

Learn how to evaluate an Affordable Health Insurance Provider, compare coverage types, and choose plans that protect your health and budget.

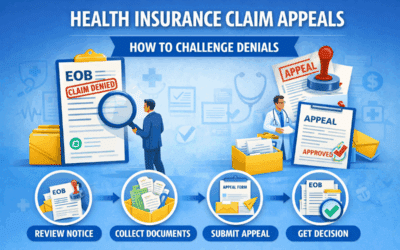

Health Insurance Claim Appeals | How to Challenge Denials

Learn how Health Insurance Claim Appeals work so you can challenge denied claims, provide documentation, and improve approval chances.

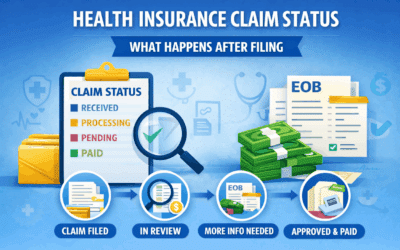

Health Insurance Claim Status | What Happens After Filing

Learn what Health Insurance Claim Status updates mean after filing and how to move a pending claim forward faster.

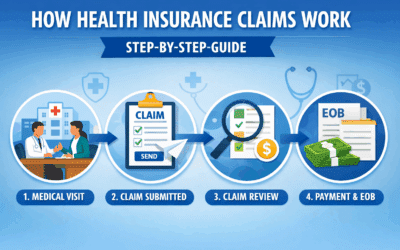

Health Insurance Claims Process | Step-By-Step Guide

Understand the Health Insurance Claims Process step by step so you can manage medical bills and avoid payment surprises.

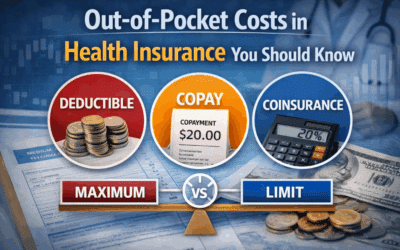

Health Insurance Cost Breakdown Guide

A detailed guide explaining health insurance costs, including premiums, deductibles, copays, coinsurance, and out-of-pocket maximums.

How Health Insurance Costs Change After Major Life Events

Health insurance cost changes often happen after major life events such as marriage, job changes, or relocation.

Out-of-Pocket Costs in Health Insurance You Should Know

Out-of-pocket health insurance costs include deductibles, copays, coinsurance, and maximum limits that affect total spending.