Welcome to Vivna Insurance of New Mexico

Finding dependable New Mexico health insurance starts with clear guidance and coverage options that fit your goals. Vivna Insurance helps individuals and families compare ACA Marketplace coverage, private medical plans, dental and vision coverage, supplemental benefits, and life insurance so you can choose protection that supports your needs and budget.

To explore plan types and how coverage works together, visit

Vivna Health Insurance.

You can also review carrier information through

UnitedHealthcare.

For general ACA guidance before comparing New Mexico options, you may reference

Healthcare.gov,

CMS.gov, and

KFF.

Vivna then applies that information to New Mexico-specific choices so you receive clear recommendations tailored to your situation.

For personalized help choosing the best New Mexico health insurance plan, call us at

888-730-6001.

Vivna Health Insurance.

You can also review carrier information through

UnitedHealthcare.

Healthcare.gov,

CMS.gov, and

KFF.

Vivna then applies that information to New Mexico-specific choices so you receive clear recommendations tailored to your situation.

888-730-6001.

VIVNA ONLY WORKS WITH

CARRIERS YOU CAN TRUST

Understanding Your New Mexico Health Insurance Options

New Mexico health insurance options can feel overwhelming without clear guidance. Vivna Insurance helps residents compare ACA Marketplace coverage, private medical plans, dental and vision coverage, supplemental benefits, and life insurance so you can choose protection that fits your needs and budget. Because every household has different care priorities, we explain each option clearly so you can make confident decisions.

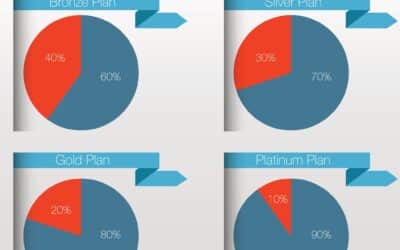

ACA Marketplace Plans in New Mexico

New Mexico residents can explore ACA Marketplace plans that include essential health benefits and follow federal standards. Additionally, some households may qualify for premium tax credits that reduce monthly premiums based on income and household size. Since plan designs vary, Vivna compares Marketplace options with private medical coverage so you can see which approach best fits your doctors, prescriptions, and expected care.

Private Medical Plans in New Mexico

Private medical plans may offer different network structures, deductible options, and cost-sharing designs. Many New Mexico residents prefer private plans when they want additional flexibility or access to specific providers. To better understand how coverage types work together, visit

Vivna Health Insurance.

Vivna then explains how private options compare to Marketplace coverage so you can choose confidently.

UnitedHealthcare Options for New Mexico Residents

Some New Mexico residents choose to review carrier-specific options when comparing plans. For example, UnitedHealthcare offers medical plan resources with nationwide provider access. You can learn more at

UnitedHealthcare.

Vivna helps explain how these options compare with other available coverage paths in New Mexico.

Dental and Vision Coverage in New Mexico

Dental and vision coverage supports preventive care and routine services that can affect overall health. Accordingly, many residents add dental and vision benefits to complement medical coverage. For guidance on dental and vision-related options, visit

Dental and Vision Coverage.

Supplemental Insurance in New Mexico

Supplemental coverage can help reduce financial strain when medical events create additional expenses. For example, certain benefits may help with out-of-pocket costs related to accidents or hospital stays. As a result, many households pair supplemental coverage with major medical plans for added financial protection. Learn more at

Supplemental Insurance.

Life Insurance Options for New Mexico Residents

Life insurance helps protect your household’s financial stability, especially when loved ones depend on your income. Additionally, it can support long-term planning and final expenses. Vivna provides guidance on life insurance options at

Life Insurance.

Why New Mexicans Choose Vivna Insurance

New Mexico residents choose Vivna because they want clear explanations, practical comparisons, and personalized guidance. Moreover, we help evaluate Marketplace coverage, private medical plans, dental and vision coverage, supplemental benefits, and life insurance. You can also explore educational resources at

Vivna Health Insurance Blog

and our main site at

Vivna.net.

Contact Us Now

If you want help comparing New Mexico health insurance options, call Vivna Insurance at

888-730-6001.

Additionally, you can review trusted health information from

NIH

and

CDC

while evaluating your next steps. For more educational guidance, visit the

Vivna Health Insurance Blog.

Get a Free Quote

FAQ — New Mexico Health Insurance

How do I compare New Mexico health insurance plans?

Begin by listing your doctors, prescriptions, and budget. Then compare ACA Marketplace coverage with private medical options. Vivna helps you understand how plan types work so you can make confident choices. To review coverage basics, visit

Vivna Health Insurance.

Are Marketplace plans the only New Mexico health insurance option?

No. New Mexico residents may also compare private medical plans, dental and vision coverage, supplemental benefits, and life insurance. For general ACA guidance before comparing options, review

Healthcare.gov.

Can I add supplemental coverage to my New Mexico health insurance?

Yes. Supplemental coverage can help reduce financial strain when medical events create additional expenses. For example, certain benefits may help with out-of-pocket costs related to accidents or hospital stays. Learn more about how supplemental benefits work at

Supplemental Insurance.

How do dental and vision options work in New Mexico?

Many New Mexico residents add dental and vision coverage to support preventive care and routine services. Vivna helps explain what dental and vision coverage typically includes and how it can complement medical plans. You can review dental and vision-related guidance here:

Dental and Vision Coverage.

How can Vivna help me choose the right plan?

Vivna helps you compare ACA Marketplace coverage, private medical options, dental and vision coverage, supplemental benefits, and life insurance. Call us at

888-730-6001

to review your doctors, prescriptions, and budget with a licensed advisor. You can also explore educational resources in the

Vivna Health Insurance Blog.

Contact Vivna Insurance

888-730-6001

To complete the form below to request your personalized insurance review.

Get a Free Quote

For additional information about dental and vision care, you can explore trusted health resources such as the

National Institutes of Health (NIH) and the Centers for Disease Control and Prevention (CDC).

Vivna Insurance helps individuals and families compare coverage options, including Supplemental Insurance,

to support a well-rounded insurance strategy. To explore all coverage options and resources, visit the Vivna Insurance home page

or browse the latest guides in the Vivna Insurance Blog.

Health & Insurance Blog Insights

Secure Child Health Insurance | Step-by-Step Enrollment Guide

Secure Child Health Insurance by following simple enrollment steps that help families protect children with reliable medical coverage and affordable plans.

Health Insurance For Kids | Family Coverage Options Explained

Health Insurance For Kids helps families protect children from unexpected medical costs while ensuring access to preventive care and reliable treatment.

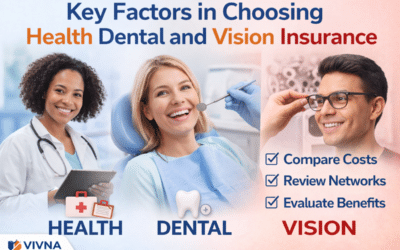

Key Factors in Choosing Health Dental and Vision Insurance

Learn key factors in choosing health dental and vision insurance, including costs, provider networks, and coverage benefits.

Affordable Health Insurance Provider | Coverage Guide & Plan Comparison

Learn how to evaluate an Affordable Health Insurance Provider, compare coverage types, and choose plans that protect your health and budget.

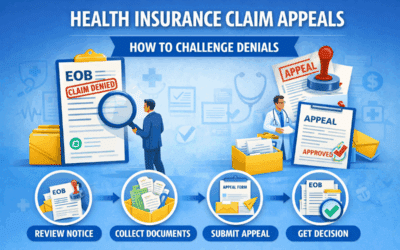

Health Insurance Claim Appeals | How to Challenge Denials

Learn how Health Insurance Claim Appeals work so you can challenge denied claims, provide documentation, and improve approval chances.

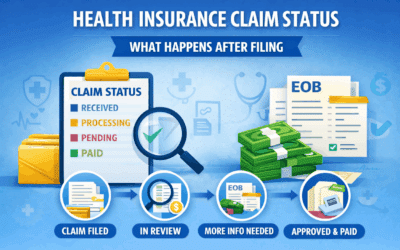

Health Insurance Claim Status | What Happens After Filing

Learn what Health Insurance Claim Status updates mean after filing and how to move a pending claim forward faster.

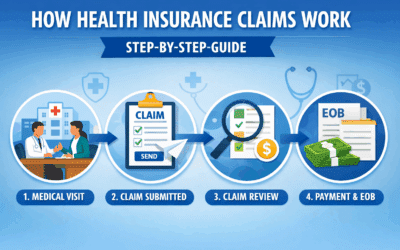

Health Insurance Claims Process | Step-By-Step Guide

Understand the Health Insurance Claims Process step by step so you can manage medical bills and avoid payment surprises.

Health Insurance Cost Breakdown Guide

A detailed guide explaining health insurance costs, including premiums, deductibles, copays, coinsurance, and out-of-pocket maximums.

How Health Insurance Costs Change After Major Life Events

Health insurance cost changes often happen after major life events such as marriage, job changes, or relocation.

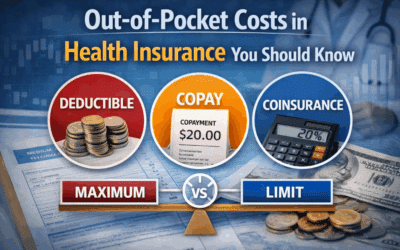

Out-of-Pocket Costs in Health Insurance You Should Know

Out-of-pocket health insurance costs include deductibles, copays, coinsurance, and maximum limits that affect total spending.