Ambetter Health

Offered by Vivna Insurance

Why Choose Ambetter Health Insurance?

Nationwide

Coverage

“Access health benefits across one of the largest national networks.”

Nationwide Coverage

Dental & Vision

Coverage

“Affordable options for routine dental care & eye exams.”

Dental & Vision Coverage

Preventive Care

Service

“$0 preventive care for routine checkups and screenings.”

Preventitive Care Services

Telehealth / Teladoc

Services

“24/7 virtual visits for convenient at-home care and services.”

Telehealth / Teladoc Services

Key Benefits of Ambetter Health Insurance

Affordable Monthly Premiums

Affordable Monthly Premiums

Prescription Drug Coverage

Prescription Drug Coverage

Mental & Behavioral Health

Meatal & Behavioral Health

Frequently Asked Questions About Ambetter Health Insurance

What preventive services does Ambetter Health Insurance cover?

Does Ambetter Health Insurance include doctor visits?

How does Ambetter Health Insurance handle specialist care?

Is hospitalization covered under Ambetter Health Insurance?

Does Ambetter Health Insurance include lab work and diagnostic testing?

Are pediatric services included in Ambetter Health Insurance plans?

What emergency care benefits come with Ambetter Health Insurance?

Does Ambetter Health Insurance provide virtual visits or telehealth services?

How do Ambetter Health Insurance prescription tiers work?

Does Ambetter Health Insurance offer dental and vision options?

Contact Vivna Insurance About Ambetter Health Insurance

Although choosing the right Marketplace plan can feel confusing,

Ambetter and Vivna Insurance make the process easier with licensed agents who explain your options clearly.

Moreover, our team reviews your doctors, prescriptions, and budget so your

Ambetter coverage matches your needs.

Additionally, you can request a quote, call our team, or complete the form below for personalized support.

Consequently, you receive confident, guided assistance instead of navigating plans alone.

You may also email us anytime at

memberservices@vivna.net

for help with your health coverage questions.

Health & Insurance Blog Insights

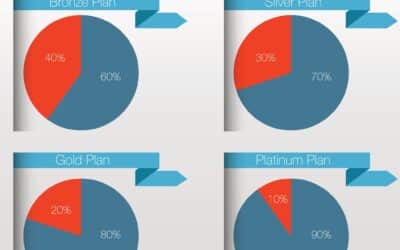

Health Insurance Cost Breakdown Guide

A detailed guide explaining health insurance costs, including premiums, deductibles, copays, coinsurance, and out-of-pocket maximums.

How Health Insurance Costs Change After Major Life Events

Health insurance cost changes often happen after major life events such as marriage, job changes, or relocation.

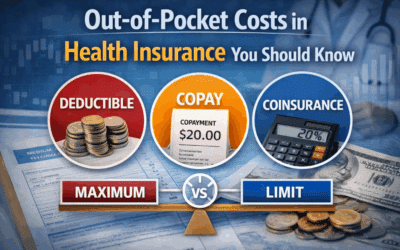

Out-of-Pocket Costs in Health Insurance You Should Know

Out-of-pocket health insurance costs include deductibles, copays, coinsurance, and maximum limits that affect total spending.

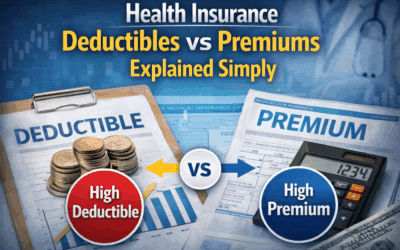

Health Insurance Deductibles vs Premiums Explained Simply

Health insurance deductibles premiums affect both monthly costs and out-of-pocket expenses when care is needed.

What Affects Your Monthly Health Insurance Premium

Several factors affect your monthly health insurance premium, including coverage design, networks, benefits, and location.

Why Health Insurance Costs Vary So Much | Vivna Insurance

Health insurance costs vary so much due to coverage levels, deductibles, networks, and regional pricing differences.

How Health Insurance Billing Works

Learn how health insurance billing works, including claims, EOBs, and patient responsibility after care.

In-Network vs Out-of-Network Costs

Learn the difference between in-network and out-of-network costs and how provider networks affect your healthcare expenses.

What Is an Out-of-Pocket Maximum

Learn what an out-of-pocket maximum is and how it protects you from high medical costs when using health insurance.

How Health Insurance Works

Learn how health insurance works, including premiums, deductibles, provider networks, and cost sharing so you can choose coverage confidently.